E-Filing Incentives

Ensuring government data is “born digital” - in other words, putting it in digital form from the time it is first collected - makes data collection faster, reduces errors in the data, and enables agencies to open the data more easily and rapidly.

E-filing can greatly increase the accuracy and accessibility of government data. It allows for electronic data protection and pre-submission validation (e.g., a phone number field can be set to only allow the entry of ten numerals) rather than the unrestricted way information is collected on paper. Many agencies have had to print, copy, and store paper forms, incurring costs that can be eliminated by switching to electronic data collection.

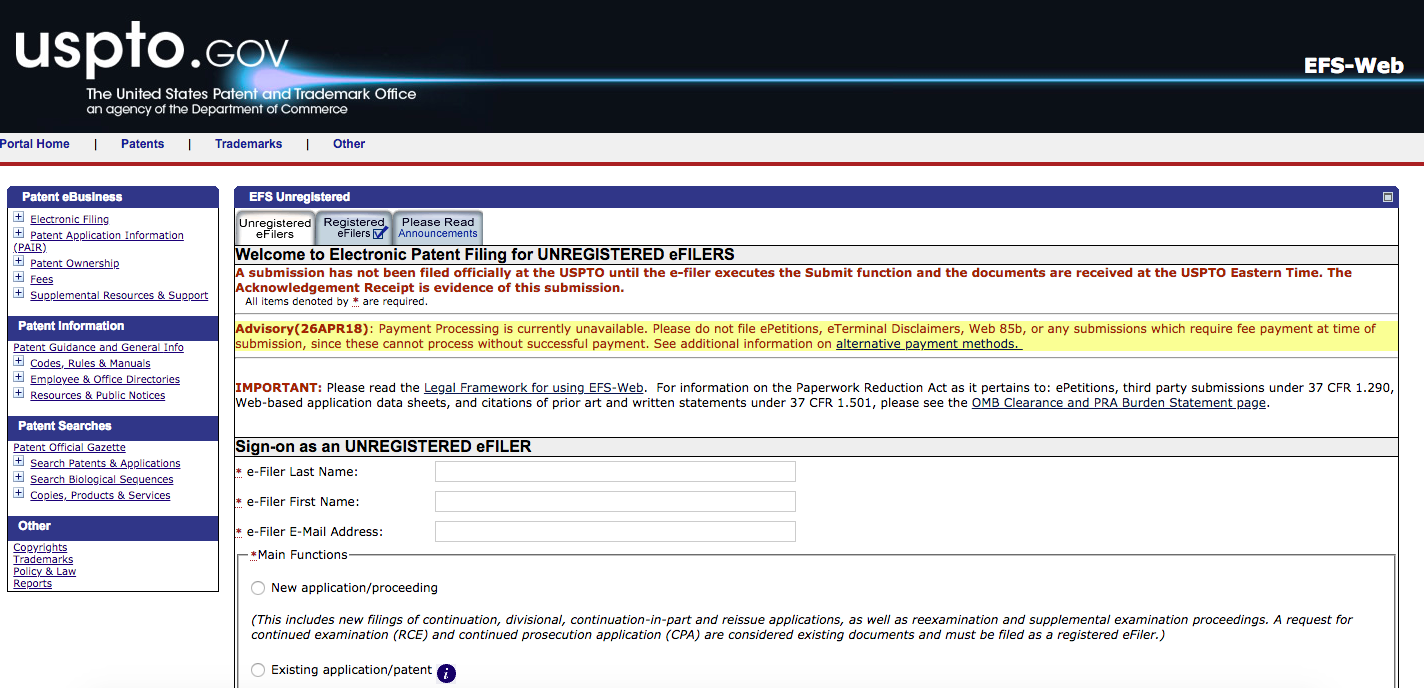

Agencies have several tools at their disposal to increase the likelihood of end-users choosing e-filing. Making the e-filing option the default, and presenting it in a way that is easy to use, can drive up its use. Disincentives for using paper forms can also encourage e-filing. For example, the Electronic Filing Incentive for the U.S. Patent and Trademark Office, which charges between $200 - $400 for paper applications, has produced a 93 percent e-filing rate.

Another example, the Centers for Medicare and Medicaid Services E-Filing Incentive, began in 2011, when Electronic Health Records (EHR) Incentive Programs were developed to encourage eligible professionals and eligible hospitals to adopt, implement, upgrade, and demonstrate meaningful use of certified EHR technology. As of 2015, more than 475,000 health care providers received payment for participating in this program.